Omdia: Chinese panel makers dominate 98-/100-inch TVs panel market boosting China's TV sector

Tue, 09 Jul 2024 18:51:00 +0800

|

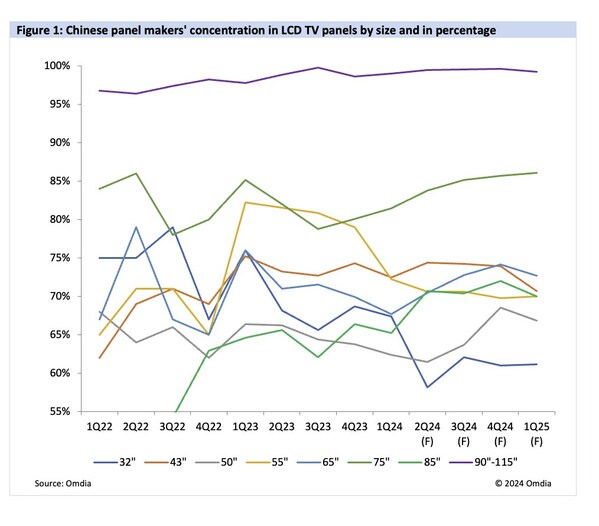

LONDON, July 9, 2024 /PRNewswire/ -- The LCD TV display industry is now an oligopoly controlled by a few powerful Chinese panel makers such as BOE, China Star and HKC Display according to new analysis from Omdia. These companies dominate 70-85% of the 65-/75-/85-inch LCD TV panel market and nearly 100% for ultra-large-sized LCD TVs (90–115-inches), according to Omdia's TV Display & OEM Intelligence Service.

From January to May 2024, leading Chinese brands such as TCL and Hisense strengthened their panel purchasing market share to 28%. Their early adoption and sourcing of ultra-large-sized panels (98-inch and 100-inch) from Chinese panel makers have been particularly notable. This strategy not only helps panel makers efficiently utilize their display production capacity but also supports Chinese TV brands in their quest to become global leaders in the ultra-large-sized LCD TV market.

While South Korean panel makers rapidly shifted to OLED TV displays, Chinese panel makers are focused on increasing the production of ultra-large-sized LCD TV displays. They aim to produce 98- to 100-inch, and eventually 100- to 115-inch to utilize their Gen 8.5, Gen 8.6, and Gen 10.5 TFT LCD capacities with plans to use Gen 10.5 for screens over 115 inches. In 2023, Chinese panel makers drove a 63% year-on-year (YoY) growth in ultra-large sizes shipments, with a 35% YoY growth expected in 2024.

"Since 2Q23, demand for ultra-large TV sizes has risen particularly among top-tier Chinese TV makers like Hisense and TCL, who have close ties with Chinese panel makers. These brands are leading the promotion of ultra-large TVs with higher product specifications in both China and North American market, the largest market for these displays since 1Q24," says Deborah Yang, Chief Analyst in Omdia's Display research practice.

"Hisense also began promoting the 100-inch LCD TVs in Europe for the UEFA EURO 2024. In 2023, TCL led in ultra-large LCD TV shipments, closely followed by Hisense, Skyworth, Xiaomi, and Samsung. Hisense aims for a 26% YoY increase in 85-inch TV shipments and a 505% increase in the 98-/100-inch TVs in 2024, and Samsung and LG Electronics plan to use 100-inch panels from Chinese suppliers for their 2025 shipments."

In Q4 2023, a price war extended to 98-/100-inch TVs in China, with 100-inch LCD TVs priced below CNY 10,000. Initially, ultra-large TVs were profitable, but Chinese brands now aim to boost shipments at lower prices to enhance their global image. Omdia believes there is a possibility of 100-inch LCD TVs being promoted at CNY 6,999 in Q4 2024, potentially leading to losses. Strategic support from panel makers is crucial for increasing adoption of ultra-large TVs.

ABOUT OMDIA

Omdia, part of Informa Tech, is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Contact: Fasiha Khan – Fasiha.khan@omdia.com

Homepage

Homepage